UNDERSTANDING THE CONSERVATIVE PROMISE: MANDATE FOR LEADERSHIP

Project 2025 Watch

EXECUTIVE BRANCH

VS

CONSTITUTION

Chapter 24:

THE ECONOMY

FEDERAL RESERVE

Review

Reading Mandate with Summary

A Summary of Project 2025 section Federal Reserve

This excerpt discusses the Federal Reserve’s role in managing the U.S. money supply and its evolving mandate over time. It argues that monetary policy has been mismanaged, leading to economic instability, recessions, and moral hazards in the financial system. Over time, Congress has expanded the Federal Reserve’s powers, making it more involved in financial regulation and broader economic policy beyond its original purpose.

The text critiques the Federal Reserve's dual mandate, arguing that focusing on economic growth alongside price stability contributes to financial crises rather than preventing them. It also points out that political pressures have influenced monetary policy, reducing the institution’s independence. The expansion of the Federal Reserve’s role, especially following crises like the Great Depression and the 2008 financial crash, has increased the risk of government overreach and financial institution bailouts. To address these concerns, the text recommends reforms including eliminating the dual mandate, restricting the Federal Reserve’s lender-of-last-resort function, and reducing its balance sheet size. These changes aim to restore its original purpose—ensuring stable money—while reducing financial instability and political influence over monetary policy.

This section expands on the critiques of the Federal Reserve, arguing that its monetary policies, including large-scale asset purchases, have contributed to economic imbalances and inflationary pressures. The text suggests that Federal Reserve interventions have subsidized government debt and distorted financial markets, particularly the housing sector. It proposes several reforms to counteract these effects:

Reduce the Federal Reserve's balance sheet – Limit asset purchases to prevent federal deficits and inflation.

Restrict future balance sheet expansions to U.S. Treasuries – Prevent the Fed from influencing asset markets by purchasing mortgage-backed or corporate securities.

End purchases of mortgage-backed securities (MBS) – These purchases have contributed to excessive housing costs and encouraged speculation.

Stop paying interest on excess reserves – This practice incentivizes banks to hold reserves rather than lending to the public, increasing financial concentration.

Implement monetary rule reforms – Reduce inflationary cycles and economic instability by constraining government monetary policy.

The text also introduces more radical ideas, such as free banking, which would remove government control over money supply and let financial institutions issue currency backed by commodities like gold. The argument is that competition among banks would create stability and limit inflation more effectively than government monetary policy.

Chapter 24:

THE ECONOMY

FEDERAL RESERVE

Review

PAGE 731-744

AUTHOR: Paul Winfree

AUTHOR BACKGROUND CHECK:

Paul Winfree is a conservative economist and policy strategist known for his influential roles in U.S. fiscal and administrative policy. He served in the Trump administration as Deputy Assistant to the President for Domestic Policy and Director of Budget Policy, where he authored key executive orders focused on reorganizing the federal government and reforming welfare systems. Prior to and after his White House service, Winfree held senior positions at The Heritage Foundation, including Director of the Roe Institute and Distinguished Fellow in Economic Policy. He also worked for the U.S. Senate Budget Committee, shaping legislation related to income security and healthcare. His academic credentials include degrees from George Mason University, the London School of Economics, and a Ph.D. from Queen’s University Belfast.

Winfree played a prominent role in Project 2025, a transition effort spearheaded by The Heritage Foundation to prepare a conservative agenda for the next Republican presidential administration. He authored the chapter on the Federal Reserve in the initiative’s policy guide,

Mandate for Leadership, proposing radical reforms such as revoking the Fed’s control over interest rates and inflation targets and replacing it with a monetary rule tied to commodity prices. His proposals reflect a deep skepticism of centralized monetary policy and an interest in reducing the federal government’s influence over the economy. Through Project 2025, Winfree continues to shape the intellectual foundation for sweeping institutional reforms in future conservative governance.

Quick Comparison of Trump and Hoover

Similarities:

Economic Conservatism: Hoover emphasized self-reliance and limited government intervention, particularly during the Great Depression. Similarly, the "Mandate for Leadership" advocates for reducing government overreach and promoting free-market principles.

Focus on Stability: Hoover's policies aimed to stabilize the economy through measures like the Reconstruction Finance Corporation, which provided loans to banks and businesses. The "Mandate for Leadership" also prioritizes economic stability, proposing reforms to the Federal Reserve to focus solely on price stability.

Skepticism of Federal Expansion: Both Hoover and the "Mandate for Leadership" express concerns about excessive federal control. Hoover resisted large-scale federal relief programs, while the "Mandate" suggests limiting the Federal Reserve's discretionary powers.

Herbert Hoover, the 31st President of the United States, and the "Mandate for Leadership" policy beliefs share some ideological similarities but also diverge significantly in their approaches and historical contexts.

Differences:

Crisis Management: Hoover's reluctance to use federal power to address the Great Depression contrasts with the "Mandate for Leadership," which proposes active reforms to reshape federal institutions.

Monetary Policy: Hoover's era did not focus on radical monetary reforms like free banking or commodity-backed money, which are central to the "Mandate for Leadership".

Modern Policy Focus: The "Mandate for Leadership" includes contemporary issues like ESG factors and central bank digital currencies, which were not relevant during Hoover's presidency.

Hoover's legacy is often debated, with critics pointing to his inability to alleviate the Great Depression and supporters highlighting his humanitarian efforts before his presidency. The "Mandate for Leadership," on the other hand, is a forward-looking policy guide aimed at shaping future conservative administrations. Both reflect conservative ideals but operate within vastly different historical and political landscapes.

What are the Pro's and Con's of the Project 2025 Proposal Reforms Concerning The Federal Reserve?

Pro's of the Mandate

Focuses the Federal Reserve on price stability rather than economic intervention

Increases transparency by requiring clear inflation targets and monetary rules

Reduces moral hazard by restricting last-resort lending

Limits government manipulation of the money supply, reducing inflationary pressures

Establishes potential alternatives like free banking or commodity-backed money to strengthen financial stability

Prevents excessive Federal Reserve intervention in asset markets, particularly mortgage-backed securities

Proposes winding down the Federal Reserve's balance sheet to curb government debt financing

Discourages financial favoritism by restricting Fed interventions in corporate and municipal debt

Strengthens banking system independence by limiting regulatory overreach

Prevents the establishment of a central bank digital currency (CBDC), protecting privacy

Con's of the Mandate

Limits flexibility in responding to financial crises

Eliminating the dual mandate may reduce employment-focused policy tools

Banks may face increased risk without Fed support in crises

Political resistance to reforming or replacing the Federal Reserve system

Transitioning to free banking or gold-backed money could be disruptive

Removing Fed interventions could cause short-term instability in housing and financial markets

Rapid reduction in balance sheet holdings could affect interest rates and liquidity

Some industries could lose financial support previously provided by the Fed

Reduced regulatory oversight may lead to unchecked financial speculation

Limits potential benefits of digital currency, such as efficiency in transactions

This section continues exploring alternatives to the Federal Reserve’s current monetary framework, presenting several reform options:

Free Banking – A system where private banks, rather than the government, control money issuance. This would eliminate the Federal Reserve and allow competition among banks to determine currency stability.

Commodity-Backed Money – A return to backing the dollar with a commodity such as gold to restrain inflation and government monetary manipulation.

K-Percent Rule – A fixed rate of money supply growth, such as 3% annually, to curb inflation while maintaining economic stability.

Inflation Targeting – The Federal Reserve sets an explicit inflation rate, typically around 2%, though concerns exist about manipulation and boom-and-bust cycles.

Inflation and Growth Targeting – Rules like NGDP Targeting and the Taylor Rule aim to stabilize spending and minimize economic downturns by adjusting interest rates strategically.

Each proposal has trade-offs, with free banking offering the most radical shift but facing political challenges, while commodity-backed money would require government discipline to maintain its peg. More moderate reforms such as NGDP targeting aim to mitigate inflation and financial instability without overhauling the current system.

This section outlines minimum reforms to improve the Federal Reserve's monetary policy and reduce its influence on economic instability. Key recommendations include:

Refocusing the Fed's mandate – Eliminate "full employment" from its objectives, focusing solely on price stability.

Transparent inflation targets – Require the Fed to specify clear inflation ranges and growth paths, avoiding vague policies like "flexible average inflation targeting."

Regulatory focus – Limit the Fed's regulatory activities to ensuring bank capital adequacy and remove environmental, social, and governance (ESG) factors from its mandate.

Curb last-resort lending – Reduce practices that encourage moral hazard and "too big to fail" institutions.

Commission for alternatives – Appoint a group to explore potential replacements for the Federal Reserve system and evaluate its financial regulatory role.

Prevent central bank digital currencies (CBDCs) – Avoid introducing CBDCs due to concerns over surveillance and control of financial transactions.

These reforms aim to simplify the Federal Reserve's role, enhance transparency, and reduce its impact on financial markets.

Understanding what this part of the Mandate means to you?

The US Federal Reserve Should Not Be Compromised Regardless on Who is in Office

Understanding How the Mandate Effects Our Government by Sections of the Mandate

The following is a breakdown of the 900+ pages in a deeper breakdown of the authors, the standards, diagnosing the reforms, deep understanding of what our tax payer dollars provide and a deeper understanding of the deep Right. We do not have a deep Left issue, we have a issue with those who are lacking credibility with plans that are outlined in black and white. Instead of just living through the next 4 years, learn from America's Mistake for allowing nepotism to override political career morally sound individuals to decide people's fate versus those who are born of privilege. In these library of collective thoughts please feel free to join the movement...

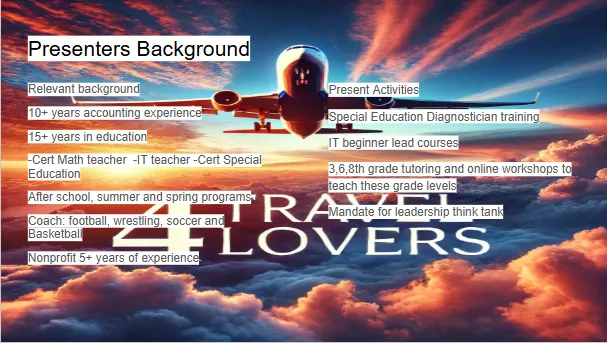

Monitoring the Mandate by diving into the authors, contributors and current implementation of the project 2025 mandate created in 1978 first ran by Ronald Raegan with the Heritage Foundation.

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Taking the Reins of Government" with break downs from

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The Common Defense" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The General Welfare" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The Economy" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Independent Regulatory Agencies" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Onward" with break down and final thoughts on project 2025:

Understanding the Mandate , What it means to you and how can we grow from learning it.

Stand up for US Department of Education Against Project 2025 Mandates

The future of education is at a crossroads, and the Department of Education plays a vital role in ensuring access to quality learning opportunities for all. However, proposed policies threaten to dismantle essential programs, impacting students, teachers, and communities nationwide. By joining together, we can advocate for a strong, well-supported education system that prioritizes inclusivity, innovation, and success. Whether through raising awareness, participating in discussions, or pushing for informed policies, every effort counts in safeguarding the integrity of public education.

This is a call to action for educators, advocates, and concerned citizens to come together and make a difference. Through collective knowledge and active engagement, we can challenge harmful reforms and champion initiatives that strengthen the Department of Education. The upcoming virtual workshop on April 21-23 will provide key insights into these urgent matters, equipping participants with the tools to take action. Let’s stand for the future of education—because protecting learning today ensures a brighter tomorrow for all. Join us in this mission and help drive meaningful change!

Power Point For 3 Day Workshop 6pm-8pm April 21-23, 2025

Understanding the Mandate Which Touches the Following

The following is a breakdown of the 900+ pages in a deeper breakdown of the authors, the standards, diagnosing the reforms, deep understanding of what our tax payer dollars provide and a deeper understanding of the deep Right. We do not have a deep Left issue, we have a issue with those who are lacking credibility with plans that are outlined in black and white. Instead of just living through the next 4 years, learn from America's Mistake for allowing nepotism to override political career morally sound individuals to decide people's fate versus those who are born of privilege. In these library of collective thoughts please feel free to join the movement...

Executive overreach redefining the Constitution and it's relationship with the other branches

The Common Defense Outlining the Agency Roles

US Press

International Press

The Economy Outlines the Roles

Case for Fair Trade

Case For Free Trade

The Independent Regulatory Agencies Outlines the Roles For Agencies

The propose for this Summary is in an attempt to allow others to understand that this mission statement known as the Mandate is different than just a political movement. This movement purpose is not meant to help those who it claims to and we would argue that their Mandate has and will do damage to our world. This has been a journey of exploration, interesting, hypocritical, short sighted and often times cruel in nature.

Small Call to Action Headline

Small Call to Action Headline

Website Development

Custom Website DesignResponsive Web DevelopmentUser Experience (UX) DesignE-commerce Website DevelopmentContent Management System (CMS) Integration

Dev Development

Full-Stack DevelopmentFrontend DevelopmentBackend DevelopmentAPI Development and IntegrationDatabase Design and Management

Scrum Master Services

Agile Project ManagementScrum Master ConsultationSprint Planning and ExecutionTeam Collaboration and CoordinationContinuous Improvement Strategies

Mobile App Design

iOS App Development

Android App Development

Cross-Platform App Development

Mobile App UI/UX Design

App Maintenance and Support

Online Marketing

Search Engine Optimization (SEO)Social Media MarketingContent MarketingEmail MarketingPay-Per-Click (PPC) Advertising

Drone Services

Aerial Photography and VideographyDrone Mapping and SurveyingInspection and Monitoring ServicesGIS (Geographic Information System) IntegrationCustom Drone Software Development

“ eMillion Concepts. eMillion People. eMillion Solutions.”

© 2024 E-Millions Consulting Services - All Rights Reserved,

etechmilli@gmail.com

(404) 723-3940

© 2026 Company Name - All Rights Reserved, consectetur adipiscing elit. Maecenas commodo suscipit tortor, vel tristique sapien