UNDERSTANDING THE CONSERVATIVE PROMISE: MANDATE FOR LEADERSHIP

Project 2025 Watch

EXECUTIVE BRANCH

VS

CONSTITUTION

Chapter 27:

INDEPENDENT REULATORY AGENCIES

FINANCIAL REGULATORY AGENCIES

SECURITIES AND EXCHANGE COMMISSION AND RELATED AGENCIES

Review

Reading Mandate with Summary

SUMMARY OF CHAPTER 27(MINUS CFPB)

SEC Recommendations:

Disclosure Restrictions: Congress should bar the SEC from requiring disclosures on ideological or non-financial information (e.g., climate-related data, ESG, diversity) unless it’s materially relevant to investors’ financial decisions. The SEC’s proposed climate rule is particularly criticized for increasing compliance costs.

Repeal of Dodd–Frank Mandates: Eliminate mandated disclosures on conflict minerals, mine safety, CEO pay ratios, and similar areas seen as non-material to investment performance.

Opposition to Social Justice Influence: Push back against redefining business purpose via CSR, ESG, stakeholder theory, or other social justice concepts.

Non-Discrimination in Regulation: Prohibit securities regulators from making rules based on race, sex, religion, or origin — either in favor or against any group.

SEC Administration Proposals:

Improve Transparency and Data Collection: The SEC, especially its Division of Economic and Risk Analysis, should publish more detailed and regular data (e.g., on offerings, enforcement, regulatory costs).

Refocus Resources: Shift SEC resources toward core regulatory and enforcement functions rather than support or non-statutory missions.

Agenda Access for Commissioners: Empower any three Commissioners to place items on the SEC agenda, ensuring staff support even without the Chairman’s backing.

Digital Assets:

Critique of SEC and CFTC Performance: Both agencies are accused of failing to develop clear rules for digital assets, instead relying on ineffective enforcement tactics. This leaves markets uncertain and investors unprotected.

Chapter 27: INDEPENDENT REULATORY AGENCIES

FINANCIAL REGULATORY AGENCIES

SECURITIES AND EXCHANGE COMMISSION AND RELATED AGENCIES

Review

PAGE 829-836

AUTHOR: David R. Burton

AUTHOR BACKGROUND CHECK:

David R. Burton, a Senior Fellow in Economic Policy at The Heritage Foundation, contributed to Project 2025 by authoring Chapter 27, focusing on financial regulatory agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). With a background in securities law, tax policy, and financial privacy, Burton has held positions including General Counsel at the National Small Business Association and Vice President for Finance at New England Machinery. His extensive experience in financial and regulatory matters informed his advocacy for significant deregulation within Project 2025. In his chapter, Burton argues that the Biden administration's regulatory approaches, particularly those emphasizing climate change and diversity, equity, and inclusion (DEI), detract from the core missions of financial agencies and hinder economic growth. He proposes streamlining regulations, reducing reporting requirements, and limiting the enforcement powers of agencies like the SEC, aiming to foster a more market-driven financial environment. Burton's contributions reflect a broader conservative perspective that prioritizes free-market principles and minimal government intervention in the financial sector.

Recommended Regulatory Clarifications:

A digital asset should only be considered a security if it provides entitlements such as profit sharing or liquidation rights.

If these conditions aren’t met, the asset should be deemed a commodity regulated by the CFTC, not the SEC.

Definitions of "commodity" and "security" should be updated to reflect this distinction, especially for digital certificates tied to physical commodities.

Legislative Backup: If regulatory agencies fail to act, Congress should legislate to establish clear rules for digital assets.

Oversight of SROs (Self-Regulatory Organizations):

Reforming FINRA and Other SROs:

Without merging FINRA into the SEC (as proposed), the following reforms should be implemented:

Public access to FINRA board meetings, agendas, minutes, and rulemakings.

Make arbitration and disciplinary hearings public and transparent.

FINRA arbitrators must explain their decisions based on evidence (except for very small claims).

Reallocation of Fines: Fines imposed by SROs (like FINRA) should go either to an investor reimbursement fund or to the U.S. Treasury — not to the SRO itself to prevent conflicts of interest.

SRO Rulemaking Transparency:

Mandate cost-benefit analyses for significant SRO rules.

Require publication of proposed rules for public comment.

Annual reports from each SRO to Congress should include enforcement data, budgets, and rulemaking activity.

Congressional Oversight:

Congress should hold annual oversight hearings on SROs.

FINRA, MSRB, and NFA should either have their own inspector general or fall under an existing one as Designated Federal Entities.

Pros and Cons of the Reform Proposals

🔹 1. Digital Asset Regulation

Pros:

Clearer guidance promotes innovation and investor confidence.

Ends inconsistent enforcement that stifles growth.

Reduces jurisdictional turf wars between SEC and CFTC.

Cons:

May weaken consumer protections if criteria are too narrow.

Could undercut SEC authority before proper legislative debate.

Needs strong bipartisan support for Congressional action.

🔹 2. Reforming SROs (e.g., FINRA)

Pros:

Transparency increases public trust and regulatory legitimacy.

Independent reviews and cost analyses may improve fairness.

Eliminating financial incentives to fine ensures ethical enforcement.

Cons:

Public disclosure of board meetings may slow decision-making.

Burdensome compliance could reduce SRO efficiency.

Merging with SEC risks reducing industry input or flexibility.

Understanding what this part of the Mandate means to you?

If the reforms outlined in Project 2025 are implemented, financial regulatory agencies like the

Securities and Exchange Commission (SEC)

,

Commodity Futures Trading Commission (CFTC)

,

Consumer Financial Protection Bureau (CFPB)

, and others could undergo significant changes that would fundamentally alter their operations and focus. Here's how:

1. Reduction in Regulatory Scope

Project 2025 emphasizes rolling back what it views as regulatory overreach. Agencies like the SEC and CFTC would likely be directed to focus narrowly on enforcing fraud and market manipulation laws, while cutting back on rules related to:

Environmental, Social, and Governance (ESG) disclosures]

Climate risk reporting

Diversity, equity, and inclusion (DEI) initiatives

2. Curtailment or Elimination of the CFPB

The Consumer Financial Protection Bureau is specifically targeted for elimination in Project 2025. This would drastically reduce federal oversight over:

Predatory lending

Credit reporting abuses

Consumer complaints in banking and lending

Its removal could leave consumers more vulnerable to financial exploitation, with enforcement falling to fragmented or weaker state-level systems.

3. Shift Toward Free-Market Principles

Project 2025 promotes deregulation in favor of “free-market” principles. This could result in:

Fewer compliance burdens for financial firms

Relaxed capital and risk-management rules

Less aggressive enforcement actions

4. Increased Executive Control

Independent agencies might lose their political insulation. Project 2025 recommends giving the President more control over these bodies, undermining their independence and possibly politicizing regulatory enforcement.

5. Consequences for Investors and Consumers

While proponents argue that deregulation would spur economic growth and innovation, critics warn it may lead to:

Increased systemic risk in financial markets

Less transparency for investors

Weaker consumer protections

In short, these reforms would shift the U.S. financial regulatory landscape from one focused on oversight and accountability to one driven by industry autonomy and minimal federal intervention.

Understanding How the Mandate Effects Our Government by Sections of the Mandate

The following is a breakdown of the 900+ pages in a deeper breakdown of the authors, the standards, diagnosing the reforms, deep understanding of what our tax payer dollars provide and a deeper understanding of the deep Right. We do not have a deep Left issue, we have a issue with those who are lacking credibility with plans that are outlined in black and white. Instead of just living through the next 4 years, learn from America's Mistake for allowing nepotism to override political career morally sound individuals to decide people's fate versus those who are born of privilege. In these library of collective thoughts please feel free to join the movement...

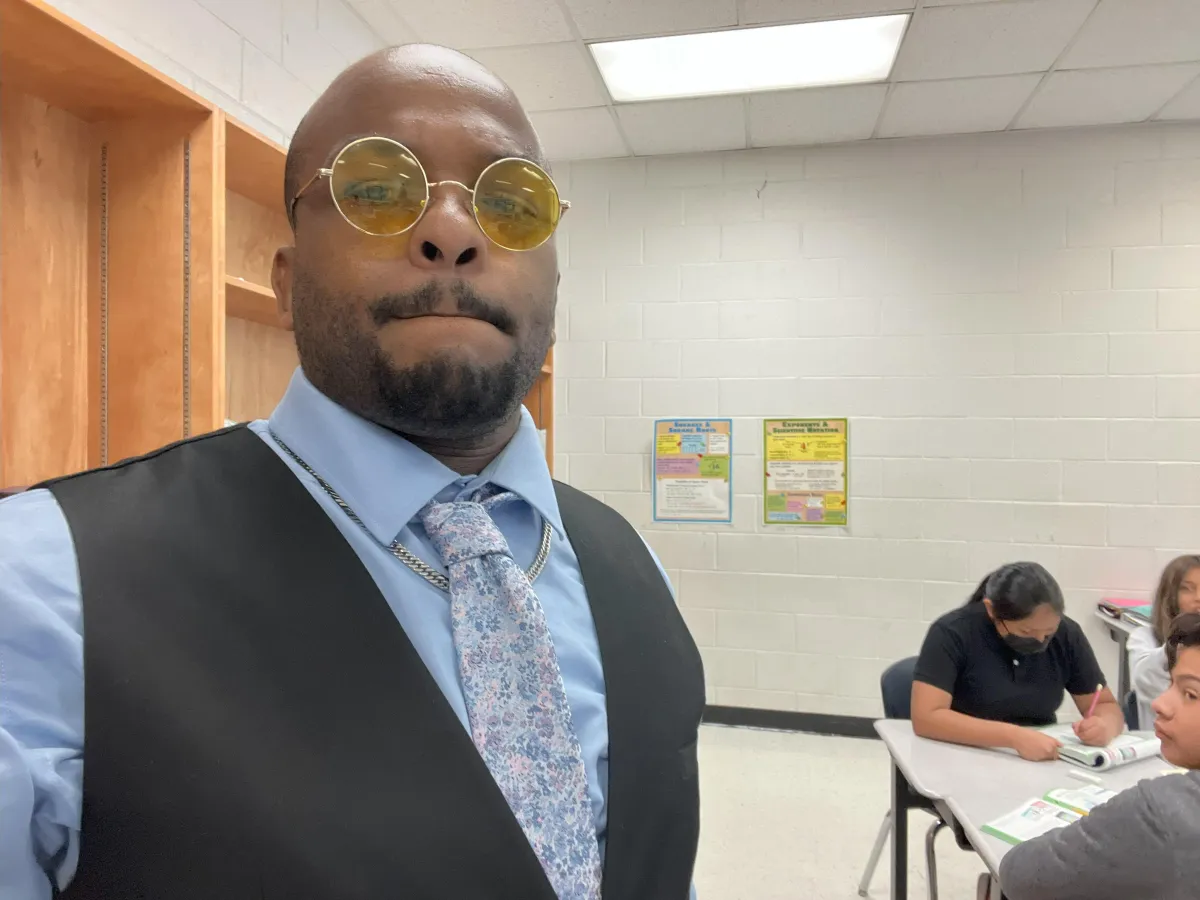

Monitoring the Mandate by diving into the authors, contributors and current implementation of the project 2025 mandate created in 1978 first ran by Ronald Raegan with the Heritage Foundation.

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Taking the Reins of Government" with break downs from

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The Common Defense" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The General Welfare" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "The Economy" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Independent Regulatory Agencies" with break downs from:

Understanding the fundamentals of the Mandate by diving into the theories, philosophies and breakdowns from the section "Onward" with break down and final thoughts on project 2025:

Understanding the Mandate , What it means to you and how can we grow from learning it.

Stand up for US Department of Education Against Project 2025 Mandates

The future of education is at a crossroads, and the Department of Education plays a vital role in ensuring access to quality learning opportunities for all. However, proposed policies threaten to dismantle essential programs, impacting students, teachers, and communities nationwide. By joining together, we can advocate for a strong, well-supported education system that prioritizes inclusivity, innovation, and success. Whether through raising awareness, participating in discussions, or pushing for informed policies, every effort counts in safeguarding the integrity of public education.

This is a call to action for educators, advocates, and concerned citizens to come together and make a difference. Through collective knowledge and active engagement, we can challenge harmful reforms and champion initiatives that strengthen the Department of Education. The upcoming virtual workshop on April 21-23 will provide key insights into these urgent matters, equipping participants with the tools to take action. Let’s stand for the future of education—because protecting learning today ensures a brighter tomorrow for all. Join us in this mission and help drive meaningful change!

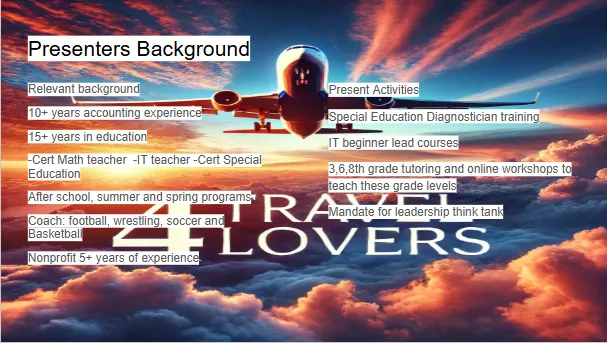

Power Point For 3 Day Workshop 6pm-8pm April 21-23, 2025

Understanding the Mandate Which Touches the Following

The following is a breakdown of the 900+ pages in a deeper breakdown of the authors, the standards, diagnosing the reforms, deep understanding of what our tax payer dollars provide and a deeper understanding of the deep Right. We do not have a deep Left issue, we have a issue with those who are lacking credibility with plans that are outlined in black and white. Instead of just living through the next 4 years, learn from America's Mistake for allowing nepotism to override political career morally sound individuals to decide people's fate versus those who are born of privilege. In these library of collective thoughts please feel free to join the movement...

Executive overreach redefining the Constitution and it's relationship with the other branches

The Common Defense Outlining the Agency Roles

US Press

International Press

The Economy Outlines the Roles

Case for Fair Trade

Case For Free Trade

The Independent Regulatory Agencies Outlines the Roles For Agencies

The propose for this Summary is in an attempt to allow others to understand that this mission statement known as the Mandate is different than just a political movement. This movement purpose is not meant to help those who it claims to and we would argue that their Mandate has and will do damage to our world. This has been a journey of exploration, interesting, hypocritical, short sighted and often times cruel in nature.

Small Call to Action Headline

Small Call to Action Headline

Website Development

Custom Website DesignResponsive Web DevelopmentUser Experience (UX) DesignE-commerce Website DevelopmentContent Management System (CMS) Integration

Dev Development

Full-Stack DevelopmentFrontend DevelopmentBackend DevelopmentAPI Development and IntegrationDatabase Design and Management

Scrum Master Services

Agile Project ManagementScrum Master ConsultationSprint Planning and ExecutionTeam Collaboration and CoordinationContinuous Improvement Strategies

Mobile App Design

iOS App Development

Android App Development

Cross-Platform App Development

Mobile App UI/UX Design

App Maintenance and Support

Online Marketing

Search Engine Optimization (SEO)Social Media MarketingContent MarketingEmail MarketingPay-Per-Click (PPC) Advertising

Drone Services

Aerial Photography and VideographyDrone Mapping and SurveyingInspection and Monitoring ServicesGIS (Geographic Information System) IntegrationCustom Drone Software Development

“ eMillion Concepts. eMillion People. eMillion Solutions.”

© 2024 E-Millions Consulting Services - All Rights Reserved,

etechmilli@gmail.com

(404) 723-3940

© 2026 Company Name - All Rights Reserved, consectetur adipiscing elit. Maecenas commodo suscipit tortor, vel tristique sapien